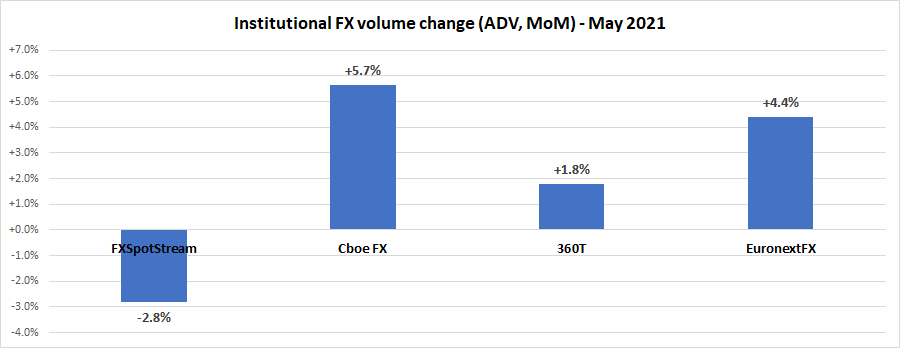

Preliminary data from leading institutional eFX trading venues indicates that May 2021 was a fairly slow month, although overall slightly better than April.

Overall, trading volumes were up 2.3% MoM in May, with all ECNs but FXSpotStream posting modest single-digit percent gains over April. April saw a sharp 16% decline in institutional trading volumes, after a very hot start to the year for FX trading throughout Q1-2021.

Cboe FX (formerly HotspotFX)

- May 2021 average daily volumes were $32.53 billion, +5.7% MoM.

EuronextFX (formerly FastMatch)

- May 2021 ADV $18.66 billion, +4.4% above April’s ADV $17.86 billion.

FXSpotStream

- In May FXSpotStream posted an ADV of USD47.335billion, an increase of 31.09% YoY vs May ‘20. May represented the 3rd highest volume month this year – USD6bio shy of a 3rd consecutive USD1 trillion month.

- FXSpotStream’s Overall Volume YoY (May ‘21 vs May ‘20) increased 31.09% to USD994.044billion.

- FXSpotStream’s ADV YoY (May‘21 vs May ‘20) increased 31.09% to USD47.335billion.

- FXSpotStream’s ADV MoM (May ‘21 vs Apr ‘21) decreased 2.81% to USD47.335billion.

- FXSpotStream’s ADV YTD (Jan-May ‘21 vs Jan-May ‘20) increased 14.97% to USD49.959billion when compared to the same period last year.

360T

- Average daily volumes (ADV) at 360T came in at $21.40 billion in May, up 1.8% from April’s $21.02 billion.