Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just reported its key operating metrics for May 2021.

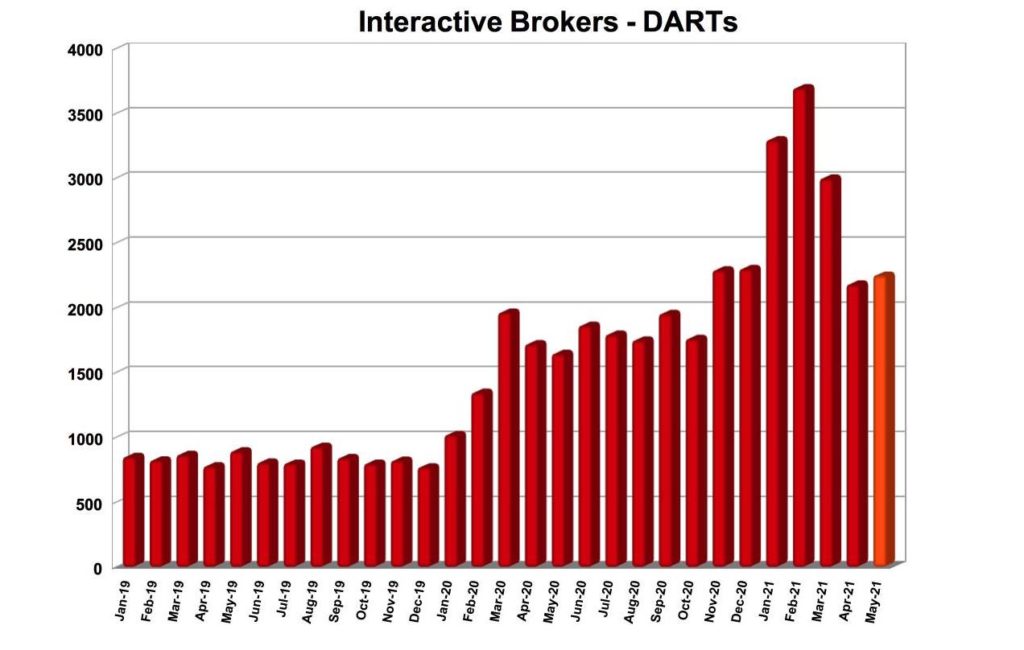

The brokerage reported 2.250 million Daily Average Revenue Trades (DARTs) in May 2021, 37% higher than in May 2020 and 3% higher than in April 2021.

Ending client equity amounted to $348.3 billion, 83% higher than prior year and 1% higher than prior month, whereas ending client margin loan balances reached $45.8 billion, 97% higher than prior year and 2% higher than prior month.

Interactive Brokers reported 1.39 million client accounts, 65% higher than prior year and 2% higher than prior month.

Let’s recall that, in the first quarter of 2021, increased market volatility pushed revenues higher.

For the first three months of 2021, the company reported diluted earnings per share of $1.16 compared to $0.60 for the same period in 2020, and adjusted diluted earnings per share of $0.98 for this quarter compared to $0.69 for the year-ago quarter.

Net revenues were $893 million and income before income taxes was $639 million for the first quarter of 2021, compared to net revenues of $532 million and income before income taxes of $308 million for the same period in 2020. Let’s note that net revenues were much stronger than in the final quarter of 2020.

General and administrative expenses for the first quarter of 2021 increased $22 million, or 59%, compared to the prior year quarter, to $59 million. This is primarily due to $19 million in additional costs for Brexit-related regulatory onboarding to bring Interactive Brokers’ new brokerage operations on line in Europe.