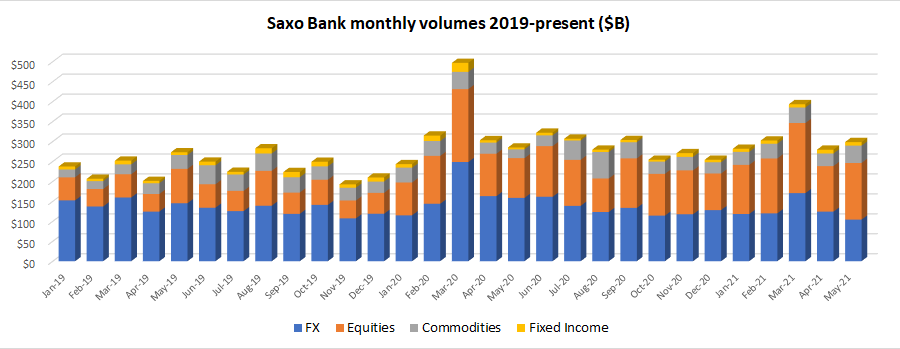

Copenhagen based Retail FX and CFDs broker Saxo Bank has reported its trading volume figures for May 2021, indicating that the company saw its lowest FX trading volumes in (at least) five years. Dating back to the beginning of 2016, Saxo’s lowest reported FX trading volumes for a full month was in November 2019 at $107.4 billion. May 2021 “topped” that, at just $104.3 billion.

Saxo’s month, however, was somewhat saved by robust Equity trading volumes, with the broker seeing one of its best months ever at $141.9 billion. This was also one of the rare months at Saxo Bank where equity trading activity surpassed core FX pair trading.

Overall, thanks again to the strong Equity trading figures, multi-asset volumes for the month of May were up 7% MoM as compared to April 2021 at Saxo Bank, $298.6 billion versus $279.5 billion. By product:

- FX – May volumes $104.3 billion, -16% MoM

- Equities – $141.9 billion, +24%

- Commodities – $43.3 billion, +37%

- Fixed Income – $9.0 billion, -4%

During May, as was exclusively reported at FNG, Saxo Bank launched crypto trading in a few geographies (Singapore, Australia, MENA) with a limited BTC, ETH and LTC offering. It will be interesting to see going forward how crypto volumes develop in the coming months. The company also made some recent management changes in its Hong Kong and China operations, a key focus area for Saxo now that it is controlled by Chinese investor Geely Group.